The Ultimate Guide To Feie Calculator

The Best Strategy To Use For Feie Calculator

Table of ContentsAn Unbiased View of Feie CalculatorWhat Does Feie Calculator Do?The Greatest Guide To Feie CalculatorGetting My Feie Calculator To Work4 Simple Techniques For Feie Calculator

He offered his United state home to develop his intent to live abroad permanently and used for a Mexican residency visa with his partner to assist fulfill the Bona Fide Residency Examination. Neil directs out that acquiring home abroad can be challenging without initial experiencing the location."We'll definitely be beyond that. Also if we come back to the United States for doctor's consultations or organization phone calls, I doubt we'll invest more than one month in the US in any kind of given 12-month period." Neil emphasizes the value of strict tracking of united state visits (Digital Nomad). "It's something that people need to be really attentive concerning," he says, and recommends expats to be mindful of typical blunders, such as overstaying in the U.S.

9 Simple Techniques For Feie Calculator

tax commitments. "The reason why united state tax on around the world earnings is such a big offer is since many individuals neglect they're still based on united state tax even after transferring." The united state is among minority nations that tax obligations its people no matter of where they live, suggesting that also if an expat has no income from U.S.

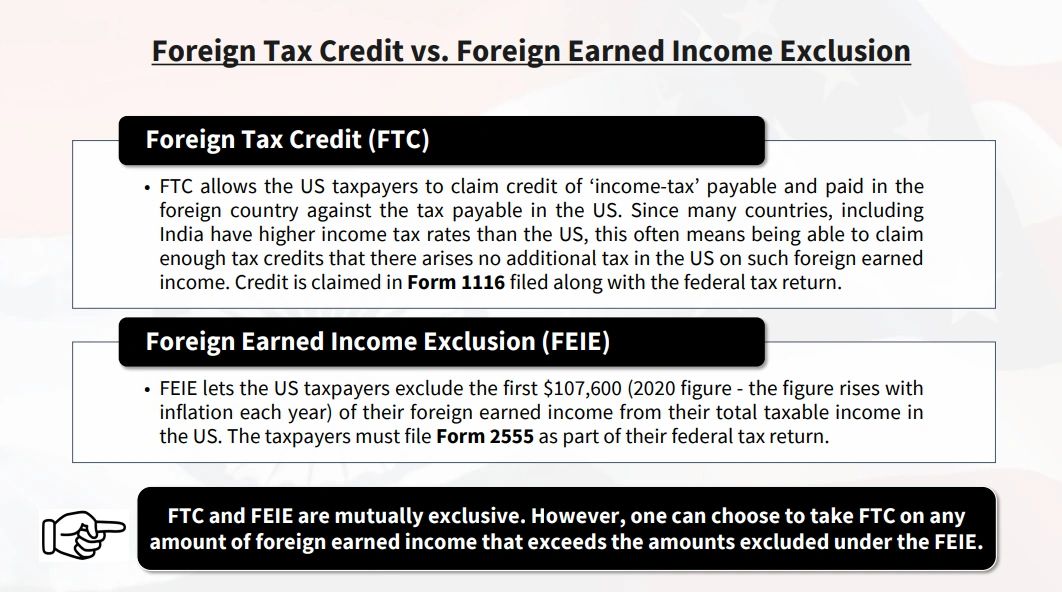

income tax return. "The Foreign Tax obligation Debt allows individuals functioning in high-tax countries like the UK to counter their united state tax obligation obligation by the amount they have actually already paid in taxes abroad," says Lewis. This ensures that deportees are not tired twice on the very same earnings. Those in reduced- or no-tax countries, such as the UAE or Singapore, face added obstacles.

Get This Report about Feie Calculator

Below are a few of one of the most frequently asked concerns regarding the FEIE and other exclusions The International Earned Income Exclusion (FEIE) enables united state taxpayers to leave out up to $130,000 of foreign-earned income from government earnings tax, reducing their U.S. tax obligation. To get approved for FEIE, you need to meet either the Physical Visibility Test (330 days abroad) or the Authentic House Test (verify your main home in an international nation for an entire tax obligation year).

The Physical Visibility Examination likewise requires U.S (Form 2555). taxpayers to have both a foreign revenue and a foreign tax obligation home.

8 Simple Techniques For Feie Calculator

A revenue tax treaty between the united state and another nation can help stop dual taxes. While the Foreign Earned Earnings Exclusion lowers taxed revenue, a treaty might provide fringe benefits for qualified taxpayers abroad. FBAR (Foreign Bank Account Record) is a called for declare united state people with over $10,000 in foreign economic accounts.

Qualification for FEIE relies on conference certain residency or physical presence examinations. is a tax obligation expert on the Harness platform and the creator of Chessis Tax. He is a participant of the National Association of Enrolled Brokers, the Texas Culture of Enrolled Professionals, and the Texas Society of CPAs. He brings over a years of experience benefiting Big 4 firms, encouraging migrants and high-net-worth people.

Neil Johnson, CPA, is a tax obligation consultant on the Harness system and the creator of The Tax Man. He has more than thirty years of experience and now concentrates on CFO solutions, equity compensation, copyright taxation, marijuana tax and separation relevant tax/financial preparation issues. He is an expat based in Mexico - https://www.kickstarter.com/profile/279303454/about.

The international gained earnings exemptions, occasionally referred to article source as the Sec. 911 exemptions, omit tax on incomes gained from working abroad. The exemptions comprise 2 components - an earnings exemption and a housing exemption. The complying with Frequently asked questions review the benefit of the exclusions including when both spouses are deportees in a general fashion.

Getting The Feie Calculator To Work

The tax obligation advantage omits the earnings from tax at lower tax obligation prices. Previously, the exclusions "came off the top" lowering earnings topic to tax obligation at the leading tax rates.

These exclusions do not exempt the earnings from United States tax but merely provide a tax obligation decrease. Note that a solitary individual functioning abroad for all of 2025 that gained regarding $145,000 with no other earnings will have taxed income reduced to absolutely no - successfully the exact same answer as being "free of tax." The exemptions are calculated each day.